Other aspects, like our have proprietary Web-site policies and whether a product is offered in your town or at your self-chosen credit rating assortment, might also impression how and where by items surface on this site. Though we try to supply a variety of offers, Bankrate does not include things like specifics of each individual economic or credit services or products.

Invoices. You can utilize your superb customer invoices as collateral to get a money advance from the lender.

Credibly is our top decide on for business proprietors with terrible credit as it approves borrowers with scores as little as five hundred. Credibly‘s working capital loan is a brief-phrase business loan that helps protect every day charges, such as getting inventory, creating payroll and paying rent. Certified borrowers could possibly obtain their funds on the identical working day they utilize.

Because the equipment functions as collateral to secure the personal debt, you don’t want to provide a down payment or possibly a blanket lien on your own business assets. But beware, just like other sorts of collateral business loans, the lender can seize your equipment when you are unsuccessful to keep up with loan payments.

Conducting comprehensive research is vital right before committing to some lender. This move assists be certain that you choose a reputable lender and stay clear of opportunity issues:

Also, the lender’s adaptable collateral prerequisites help it become extra obtainable than other sorts of classic financing.

Our editorial group doesn't get immediate compensation from our advertisers. Editorial Independence Bankrate’s editorial staff writes on behalf of YOU – the reader. Our target is usually to give you the best tips that can assist you make good private finance conclusions. We follow strict guidelines in order that our editorial information will not be affected by advertisers. Our editorial team receives no direct compensation from advertisers, and our information is totally point-checked to guarantee accuracy. So, no matter whether you’re examining an article or a review, it is possible to trust that you simply’re acquiring credible and dependable details.

Execs In-human being customer service and expert insights Presents bargains for veterans Absolutely free benefits plan for business users Drawbacks Doesn’t disclose optimum rate ranges Not ideal for startups May need to apply around the cellphone or in particular person Why we picked it

Having said that, The dearth of collateral doesn’t signify you’re off the hook for those who don’t repay your unsecured loan. Some lenders may put a lien on the business assets or call for you to sign a private ensure. Your credit score may also probable have a strike.

On the other hand, if you need working capital or would like to fund an growth, a business time period loan could possibly be a far better suited selection.

Romance-building using a lender: You could build a lending romance that you might leverage any time you need to have extra funding Sooner or later. A lender may very well be far more prone to approve you for potential loans if you already have a longtime partnership with them.

Most secured business loan purposes could be done online, but some lenders could demand a mobile phone connect with or in-person take a look at. Since the lender needs to evaluate your assets, secured business loans ordinarily just take extended to approve and fund.

Commercial real-estate loans are utilised to get or renovate professional Attributes. Much like how equipment financing works, these loans are secured because of the professional home that you just’re getting or renovating.

It is possible to entry different business loans with a how to get an unsecured business loan traditional bank or credit union. Generally, these lenders offer aggressive charges and terms, but prerequisites might be quite rigorous, frequently necessitating a reliable credit record and profits, furthermore a number of yrs in business. You may additionally really need to pay a lot more charges and provide collateral to secure the cash.

Luke Perry Then & Now!

Luke Perry Then & Now! Melissa Joan Hart Then & Now!

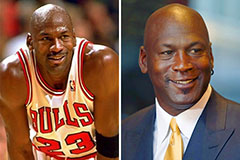

Melissa Joan Hart Then & Now! Michael Jordan Then & Now!

Michael Jordan Then & Now! Matilda Ledger Then & Now!

Matilda Ledger Then & Now! Samantha Fox Then & Now!

Samantha Fox Then & Now!